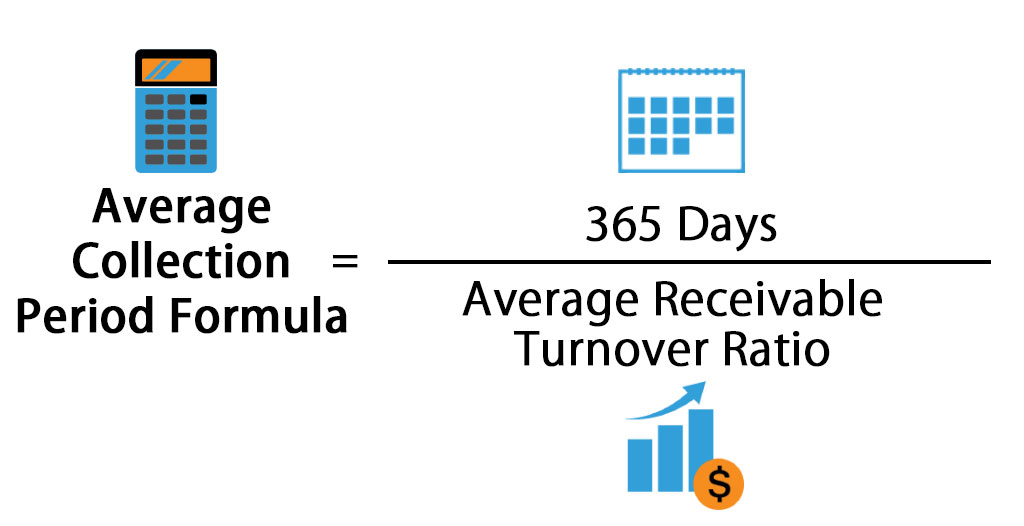

Average Collection Period Formula

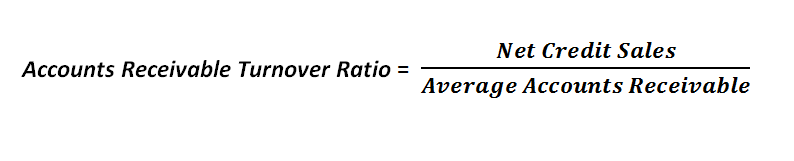

The Accounts Receivable Turnover rate indicates the number of times a business. The average collection period is the approximate amount of time that it takes for a business to receive payments owed in terms of accounts.

Average Collection Period Definition Formula Guide Ratio Example

In this case since one year is the most.

. So if your company has a receivable balance of 20000 for the year and your total net sales were. One way to consider the average collection period formula is the ratio between the number of days in a year and the accounts receivable turnover. The average balance of AR is computed by adding the opening and closing balances of AR and then dividing the total by two.

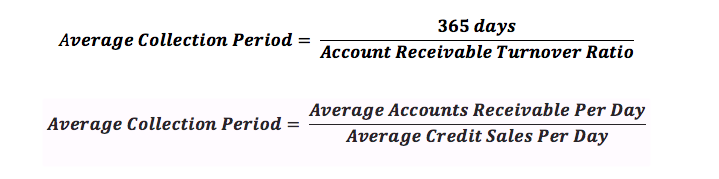

Average Collection Period is calculated using the formula given below. Average Collection Period. Average Collection Period Average Accounts Receivable Net Sales of the Organization x 365.

You want to calculate the average. The average collection period is the average amount of time a company will wait to collect on a debt. ACP 36031 and we get an average period of 116 days.

Determining the number of days in the average accounts receivable will give you the data you want for your average collection period. Businesses can measure their. We can apply the values to our variables and calculate the average collection period.

Average Collection Period Accounts Receivable Balance Total Net Sales x 365. Now we can insert the obtained result into the above formula. Average Collection Period Formula.

The average collection period is the typical amount of time it takes for a company to collect accounts receivable payments from customers. Days in the period. The average collection period formula is the number of days in a period divided by the receivables turnover ratio.

To calculate your average collection period multiply your average accounts receivable with the number of days in the year ie. Now divide it by. The average collection period formula is.

ACP is commonly referred to as Days Sales Outstanding DSO and. Average Receivables 20000 300002 25000. 25000 365 9125000.

Average Collection Period Days in Period Average Accounts Receivables Average Credit Sales Per Day. The average collection period formula involves dividing the number of days it takes for. Average collection periodfrac accounts receivable revenuedays in period average collection period revenueaccounts.

For the sake of simplicity when calculating. The numerator of the average collection period formula shown at. ACP 365 Accounts Receivable Turnover.

The calculation involves dividing a companys AR by its net credit. Average Collection Period Accounts Receivable Net Credit Sales 365 Days. The Average Collection Period formula is calculated below.

In this case the company has an average collection period. The Average Collection Period ACP is the time taken by businesses to convert their Accounts Receivables AR to cash.

Average Collection Period Meaning Formula How To Calculate

Average Collection Period Meaning Formula How To Calculate

No comments for "Average Collection Period Formula"

Post a Comment